How to start a Foundation or NGO in Nigeria By Registering as an Incorporated Trustee with CAC

Hello FINT, I just laid my mom to rest. Rather than a flamboyant burial, I would like to start a Foundation in order to immortalize her legacy. What do I need to do?

Answer: Please accept our condolences.

That’s a wise decision to immortalize your mother’s legacy through a foundation. We will give you a detailed answer that explores pre-registration steps, registration steps, features of Incorporated Trustees and costs involved.

In Nigeria, the vehicle for registering an NGO (Non-Governmental Organization) is Incorporated Trustees as provided under Section 590 of the Companies and Allied Matters Act (CAMA). NGOs are non-profit organizations set up for the purpose of furthering a cause, which could be “religious, educational, literary, scientific, social/cultural development, sporting and charitable”. In an earlier article, we made a comparison between two for-profits, a business name and a limited liability company.

Image by Mary Pahlke from Pixabay

Image by Mary Pahlke from Pixabay

Image by maz-Alph from Pixabay

Important Features of Incorporated Trustees (Vehicle for registering an NGO with CAC)

Image by maz-Alph from Pixabay

Important Features of Incorporated Trustees (Vehicle for registering an NGO with CAC)

Image by Mary Pahlke from Pixabay

Image by Mary Pahlke from Pixabay

Pre-Registration

To start an NGO, one has to pick a cause from any of the seven mentioned above. This is the vehicle used to register churches, religious ministries, initiatives and so on.- After this, there should be a brainstorming session where the beliefs, purpose, mission and vision of the NGO are put on paper.

- There should also be a list of the activities the NGO intends to undertake.

- You will need this information during registration.

- The first step after picking a cause and doing all of the above is to reserve the name with CAC (Corporate Affairs Commission).

- Appoint trustee(s) who should be someone with a passion for the cause chosen and also above 18 years, not of unsound mind, not bankrupt and not a convict within the last five years. It is possible to have only one Trustee. Name, date of birth, nationality, address, occupation, government-issued ID and passport photograph, are the details each appointed trustee needs to present during registration.

- Hire an accredited CAC agent. Note that not all lawyers are accredited with CAC, so ensure the lawyer you hire is accredited. Your lawyer will handle things like drafting of the NGO’s constitution, the publication of notices and requisite minutes of meetings.

Registration

Upon approval of the name reservation, your lawyer will begin preliminary data entry on the CAC portal. Remember that name reservation is only valid for 60 days. In the meantime, your lawyer will handle and prepare the following:-

- Publication of Notices in three national dailies. The publication is expected to notify the public of the intention to register the NGO, the name of the NGO, the name of the Trustees, the NGO’s aims and objectives and calls for objections to its registration within 28 days of publication. This should be done immediately the name is approved as the 28 days must have passed before it will be accepted by CAC.

- Drafting of the Constitution which will contain the rules that will guide the NGO’s internal affairs and operations. It is expected to include the aims and objectives, statement of purpose, governance structure, a list of the members of the Board of Trustees, and so on.

- Drafting of Minutes of Meeting for the appointment of the Board of Trustees. This minutes should also contain a list of members present and absent at the meeting, the voting pattern used for the appointment, and the authorization to apply to CAC for registration. The minutes is to be signed by the Chairman or Chairwoman and the secretary of the Board of Trustees.

-

- Drafting of Minutes of Meeting for the adoption of the special clause into the constitution. The minutes is to be signed by the Chairman or Chairwoman and the secretary of the Board of Trustees.

- The common seal of the NGO. The impression of the common seal will be needed on the minutes, the application form and some other documents.

- All of the above documents are to be prepared in duplicate. After which they are scanned, uploaded and filed on CAC portal.

- Upon approval of registration, the original documents will then be submitted at the chosen CAC branch office for collection of the certificate of incorporation.

Image by maz-Alph from Pixabay

Important Features of Incorporated Trustees (Vehicle for registering an NGO with CAC)

Image by maz-Alph from Pixabay

Important Features of Incorporated Trustees (Vehicle for registering an NGO with CAC)

- It is not a business and does not distribute profits.

- Income is generated through grants, donations, levies, membership fees, etc.

- 100% of income must be applied solely towards its causes.

- They are not liable for tax, except for income gotten through business or trade.

- Just one person is sufficient to register it.

- While the minimum number of trustees is at one, CAMA is silent on the maximum number.

- Upon incorporation, it obtains a distinct legal personality that can sue and be sued, and own properties.

- The trustees alone, excluding members, are the ones clothed with a new legal personality.

- Its correct legal name starts with “Incorporated Trustees of …”

- Used to incorporate Associations, Foundations, Initiatives, Churches, Mosques, Clubs, etc.

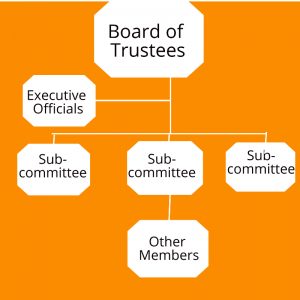

- The Board of Trustees is different from the executive members, also different from the sub-committee members and other members. An executive member may or may not be a member of the Board.

- A bank account can be opened in the name of the NGO using the certificate of incorporation.

Cost and duration of registering an NGO

As you can see from the details above, registering an NGO involves several variables. You can expect registration costs to start from ₦200,000 and take at least six weeks to conclude.Can a foreigner be a member of the board of trustees?

Yes, a foreigner can be a member of the board of trustees. However, such a foreigner must have a valid residence permit, specifically the Combined Expatriate Residence Permit and Alliance Card (CERPAC). So, if you want a foreigner to join your BoT, they first have to obtain CERPAC.Why you should register your NGO

It is actually possible to run a non-profit without registering it. However, those running it will not be able to access certain benefits that registration affords them. Some of these benefits include:-

- Corporate legal personality. This is the first benefit of registration. The NGO becomes an artificial person distinct from the Trustees. It can sue and be sued. It can own properties in its name, and such properties belong to the NGO and not the individual Trustees.

- Continuity. Where the founder dies or even leaves, the NGO will not die as long as there are other members of the Board of Trustees. NGO can only end through a court order.

- Tax Avoidance. This is a legitimate way to reduce tax obligations. It is not the same as tax evasion which is illegal.

-

- Protect the Name. Upon incorporation of the NGO, no one else can use the same or a closely similar name. This helps to protect the brand’s identity.

- Banking and Credit. With the certificate of incorporation (CoI), an NGO can get its own bank account. With this bank account and the CoI, it can apply for credit financing to be used towards promoting its cause.